How to retire in 10 years

Business Times released an article earlier this year, Jan 17 to discuss the possibility that one can

retire in 10 years. Here is the link for the

complete article.

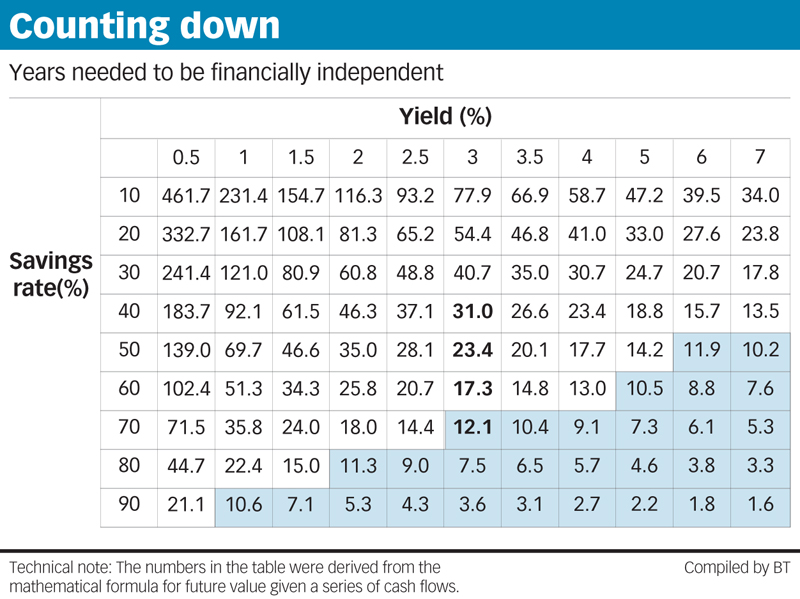

The claim is that “At very high saving rates of 70, 80 or even 90%, the time to financial independence is

dramatically shortened. A 80% saver will achieve financial independence in just 11.3 years assuming 2% yield a year.”

Now, there are a few assumptions about this statement.

- The definition of financial independence here assumes that you have sufficient income (passive or active) to cover your monthly expenses which do not increase over time.

- Savings here is not absolute. Rather, it is expressed as a percentage of your income. 40% savings rate for an income of $10,000 will result in the same number of years for a person with 40% savings rate for an income of $5,000.

- Higher yield will result in lesser number of years to reach early retirement. Naturally, high risk high returns.

- As Singaporeans, we have to contribute to our CPF funds. This savings is not considered separately.

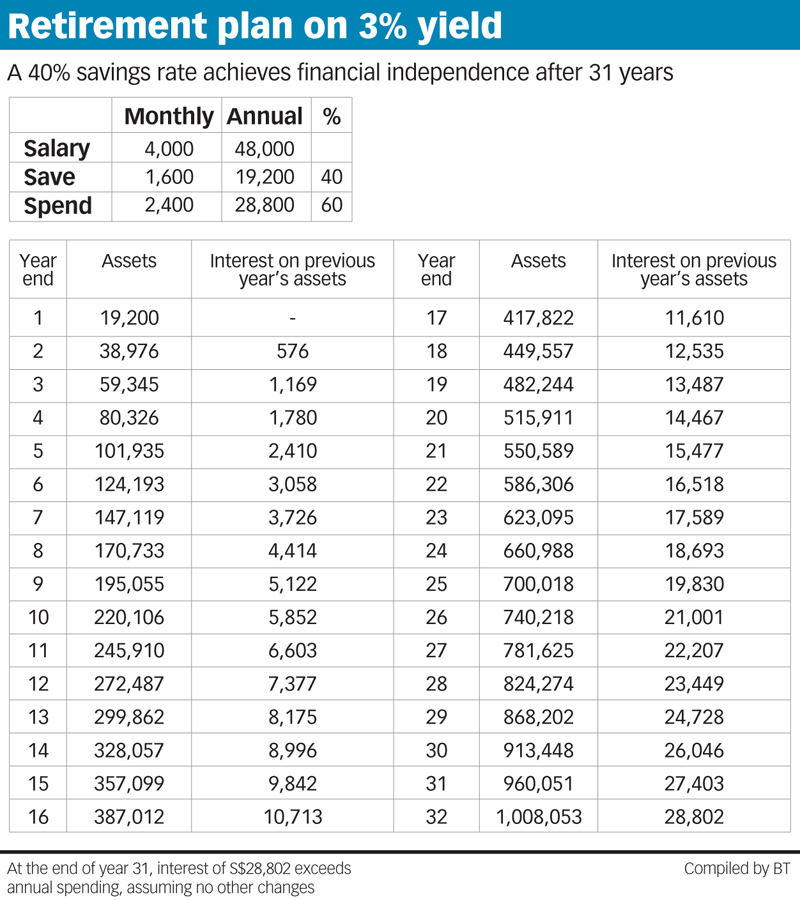

Below is an example highlighted in the article.

Finally, here is the saving rates versus yield.

Some food for thought:

- How does it change for a single person, couple(no dependent) and couple(with dependents)?

- How likely is it for expenditures not to increase over time?

- Is 3% yield reasonable? (I will say it is.)

At the end of the day, all these choices are up to individuals to decide. Afterall, there is a reason why it is called personal financial

planning. Only you can decide how you want to spend your money?

Leave a comment