Forex Trading Basics

I came across this interview with Rayner on trading matters and found his insights pretty interesting. Happens that he has his own website called TradingwithRayner too. Most importantly, he has a series of educational videos on trading for FREE! Having procrastinated on formally creating a trading plan, I decided to embark on this endeavor to cover his videos.

Introduction

Firstly, Forex stands for Foreign Exchange.

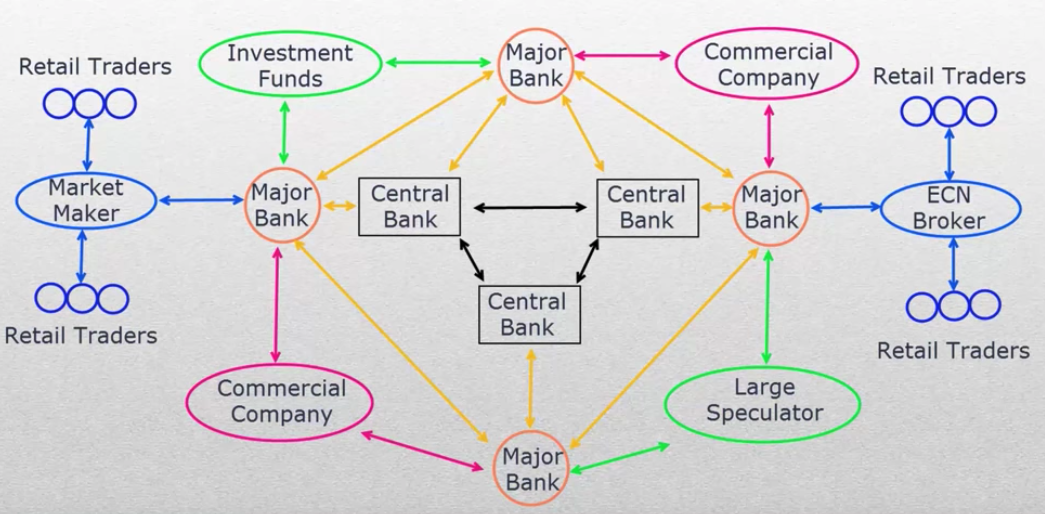

So who are the key players in the market?

Credits: TradingwithRayner

Credits: TradingwithRayner

Currency pairs

Major currency pairs to trade:

- EUR/USD

- GBP/USD

- USD/CHF

- USD/JPY

- AUD/USD

- NZD/USD

- USD/CAD

Trading sessions

Best trading sessions to trade are Tue, Wed and Thur from 3pm to 10pm where there is overlap between Asia, London and New York markets.

Definition of a pip

Smallest unit of a particular forex pair.

Pip stands for Point in Percentage. It is usually 4 decimal places except for Japanese Yen pairs which are typically 2 decimals.

Bid price is the selling price. Ask price is the buying price. Usually, bid price < ask price.

Spread is the difference between bid and ask prices. This is where brokers earn their “commissions”.

Lot Size

Standard lot (100,000 units) Mini lot (10,000 units) Micro lot (1,000 units) Nano lot (< 1,000 units)

Types of forex orders

- Market

- Enters market immediately at the ask price.

- Limit

- Enters market at specified price.

- Stop

- Enters market when it moves in your favor.

- Stop loss

- Leaves market when it moves against you.

Types of forex charts

- Line

- Bar

- Candlestick

Types of Anaylsis

- Fundamental

- Technical

- Sentiment

[To be continued…]

Leave a comment